iPhone Trade-in Vs. Brand Retention

Apple's Decline in Sales During Q1-Q2 2019 Visible as 15.2% Less Trade-In Savvy iPhones Owners Are Sticking With Apple, compared with CIRP's 2018 Activation Survey.

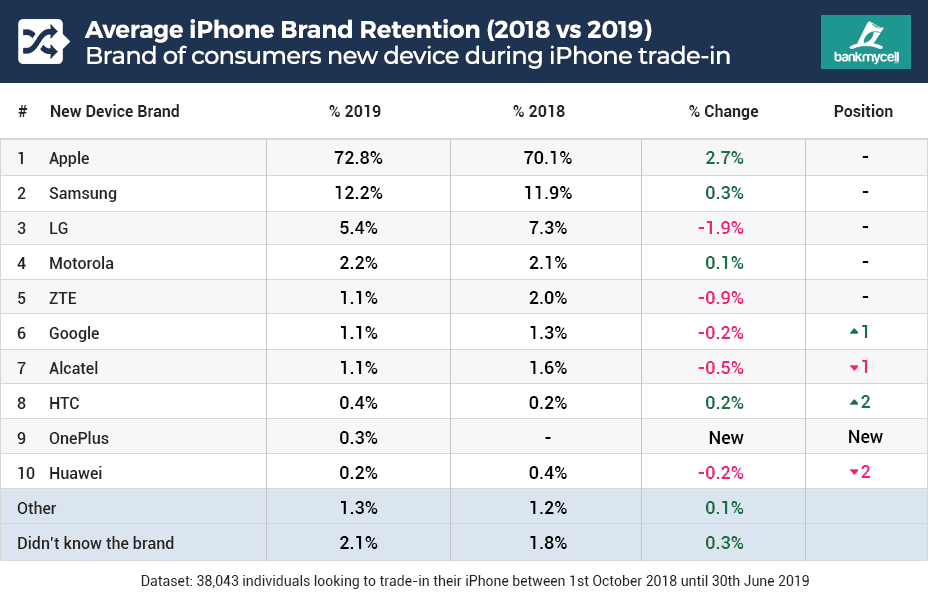

Since October 2018, iPhone trade-in site BankMyCell has been collecting data on the new device people have during the valuation and trade-in of their old iPhone. The result is a vast dataset of 38,043 individuals, providing insight into consumers upgrade cycle patterns and Apple’s brand loyalty during the online trade-in process.

Key Stats: iPhone Retention

- 2019’s trade-in savvy iPhones owners are -15.2% less loyal than CIRP’s 2018 survey.

- iPhone brand retention the lowest it has been since 2011, compared to various studies.

- On average, 70.8% of iOS user’s remained with Apple during an iPhone trade-in from Q4’18 to Q2’19.

- Only 66.4% of iOS users trading in stayed with Apple during Q4 of 2018, following the release of the iPhone XR / XS range.

- The iPhone XS was in the bottom four devices for same brand upgrades, only 65.3% of users currently used an iPhone.

Key Stats: Apple VS Android

- In June 2019, 18.08% of people trading in iPhones had a Samsung device, the highest figure recorded in our study.

- 24.5% of individuals trading in iPhones during Q4 2018 had moved to a new brand; Samsung (13.8%), LG (8.2%) or Motorola (2.5%).

- On average, 12.4% of iPhone users jumped ship to Samsung, and 6.4% to LG smartphones from Q4’18 to Q2’19.

- 18.5% of people selling an iPhone XS had moved to Samsung – the most significant Apple to Samsung brand switch out of 16 phones.

- 26.2% of individuals trading in their iPhone X moved to another brand compared to only 7.7% of Galaxy S9 users switched to an iPhone, leaving 92.3% predominantly on Android.

EXPLORE THE REPORT FINDINGS BELOW

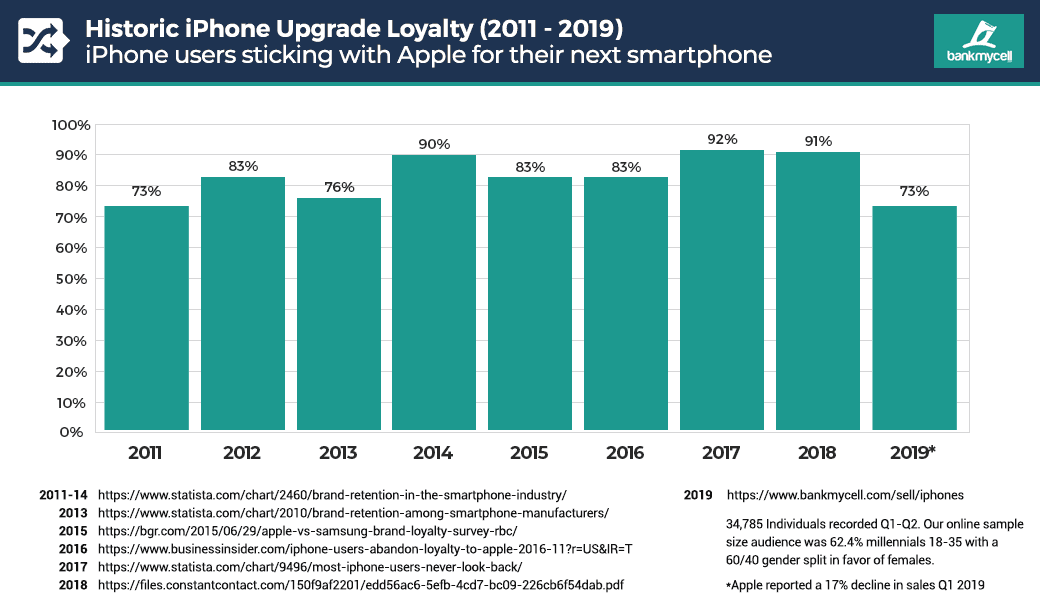

Historic iPhone Upgrade Loyalty

In March 2018, Consumer Intelligence Research Partners (CIRP) released data showing 86% of users with an iOS mobile operating platform remained loyal, using a sample size of 500 individuals.

- 2019’s trade-in savvy iPhones owners are -15.2% less faithful than CIRP’s 2018 survey.

- iPhone brand retention the lowest it has been since 2011, compared to various studies.

What was interesting when benchmarking this data against ours, was the considerably lower -15.2% of trade-in savvy iPhone uses remained loyal in 2019, this data tied in well with the report of sales declining 17%. In addition, our online audience 62.4% millennials with a 60/40 gender split in favor of females, which may differ from CIRP; however, they did not mention demographics in their release.

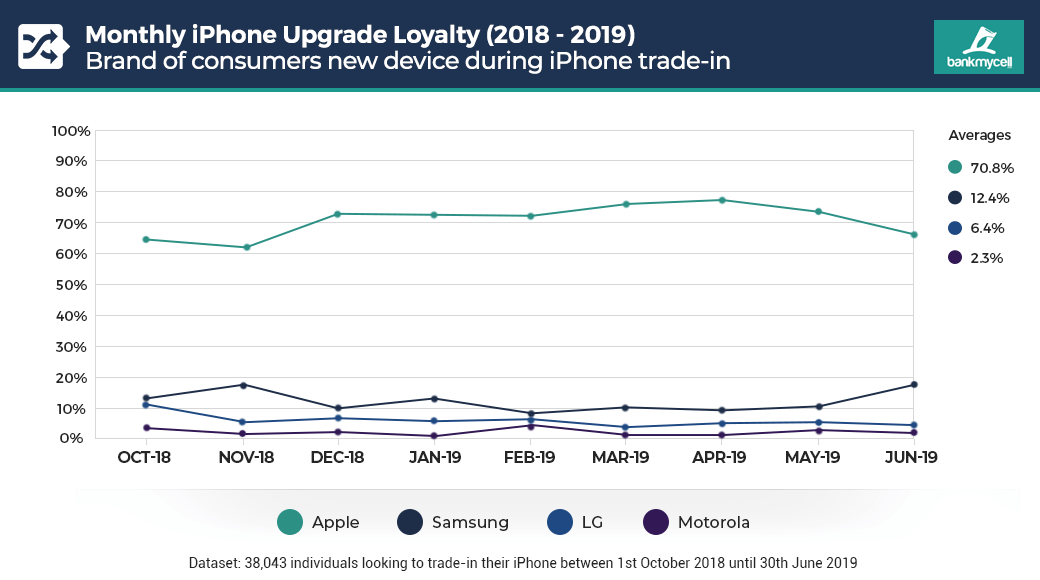

Monthly iPhone Trade-in Loyalty (2018 - 2019)

Below we see the monthly brand retention of people trading in their iPhones over 9 months. This shows low retention during following the XS / XS Max / XR release, followed by a boost during Q1 and Q2 (typically Apple’s highest quarterly revenue periods since 2007). We also see Apple’s brand retention at iPhone trade-in drop down into the 60-70% band. The vast majority of this decline was due to people selling iPhones while using a new Samsung device.

38,043 Individuals – iPhone trade-in / valuation data from 10/2018 – 06/2019:

- On average, 70.8% of iOS user’s remained with Apple during an iPhone trade-in from Q4’18 to Q2’19.

- In June 2019, 18.08% of people trading in iPhones had a Samsung device, the highest figure recorded in our study.

- On average, 12.4% of iPhone users jumped ship to Samsung, and 6.4% to LG smartphones from Q4’18 to Q2’19.

- 14.9% went to other manufacturers, while 1.9% didn’t know what brand their phone during Q4’18 to Q2’19.

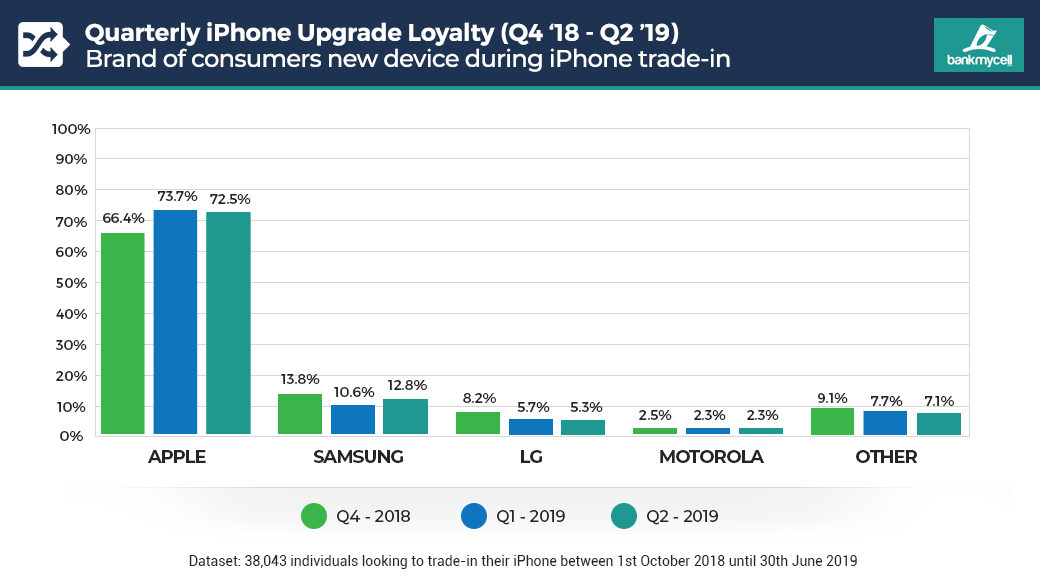

Quarterly iPhone Trade-in Loyalty (Q4 2018 – Q2 2019)

Below we see the quarterly brand retention trend of people trading in their iPhones (Q4’18 – Q2‘19). This chart shows the gains and losses of iPhone users to other brands, grouping each manufacturer to visually observe quarterly movements.

38,043 Individuals – iPhone trade-in / valuation data from Q4 2018 – Q2 2019:

- Only 66.4% of iOS users trading in were loyal during Q4 of 2018 following the release of the XS XR range.

- 24.5% of individuals trading in iPhones during Q4 2018 had moved to a new brand; Samsung (13.8%), LG (8.2%) or Motorola (2.5%)

- The highest recorded brand retention was 73.5% in Q1 2019, taking 5.7% back from lost users to Samsung and LG

- In Q2 2019, Samsung was the only brand to sway iPhone users, taking back 2.2%, leaving 72.5% staying with Apple after trade-in.

iPhone X Upgrade Loyalty Compared to Galaxy S9 (2019)

Below we have a comparison of the iPhone X and Galaxy S9 brand retention. These device-specific samples show that fewer Samsung users were changing to iOS, compared to double the percentage of iPhone users going to Samsung.

2,427 Individuals – iPhone X VS Galaxy S9 trade-in loyalty 01/2019 – 06/2019:

- 26.2% of individuals trading in their iPhone X moved to another OS, e.g. Android/RIM/Windows

- Only 7.7% of Galaxy S9 users switched to an iPhone, leaving 92.3% on Android/RIM/Windows

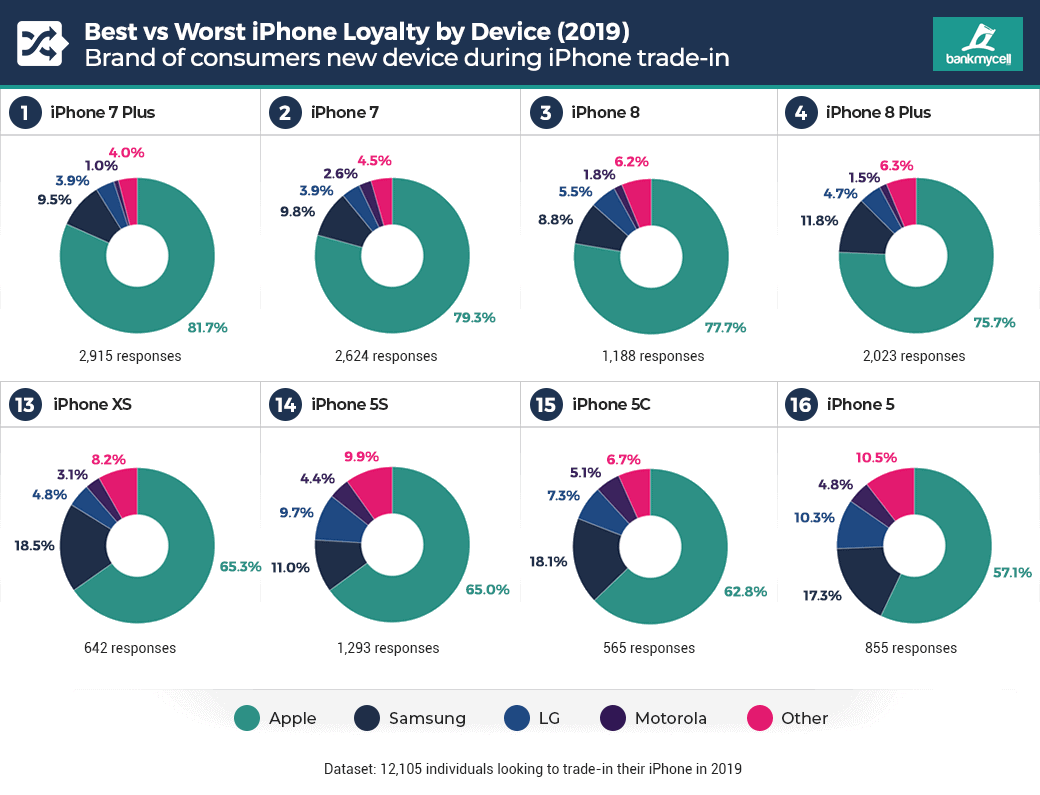

Best vs. Worst iPhone Upgrade Loyalty by Device (2019)

Below we show each end of the retention scale as user’s trade-in iPhones on a device specific level. The overarching storyline here is where almost 1 in 5 individuals trading in the iPhone XS had a Samsung device (compared to an iPhone 8 where less than 1 in 10 had.)

12,105 Individuals – iPhone trade-in / valuation by device from 01/2019 – 06/2019:

- Individuals trading in their iPhone 7 Plus owners were the most loyal, with 81.7% of respondents sticking with Apple.

- Only 57.1% of iPhone 5 owners have an iPhone as their current device.

- Last year’s iPhone XS was in the lowest devices for Apple loyalty, with 65.3% of users currently using an Apple device.

- 18.5% of people selling an iPhone XS had moved to Samsung – the most significant Apple to Samsung brand switch out of 16 phones

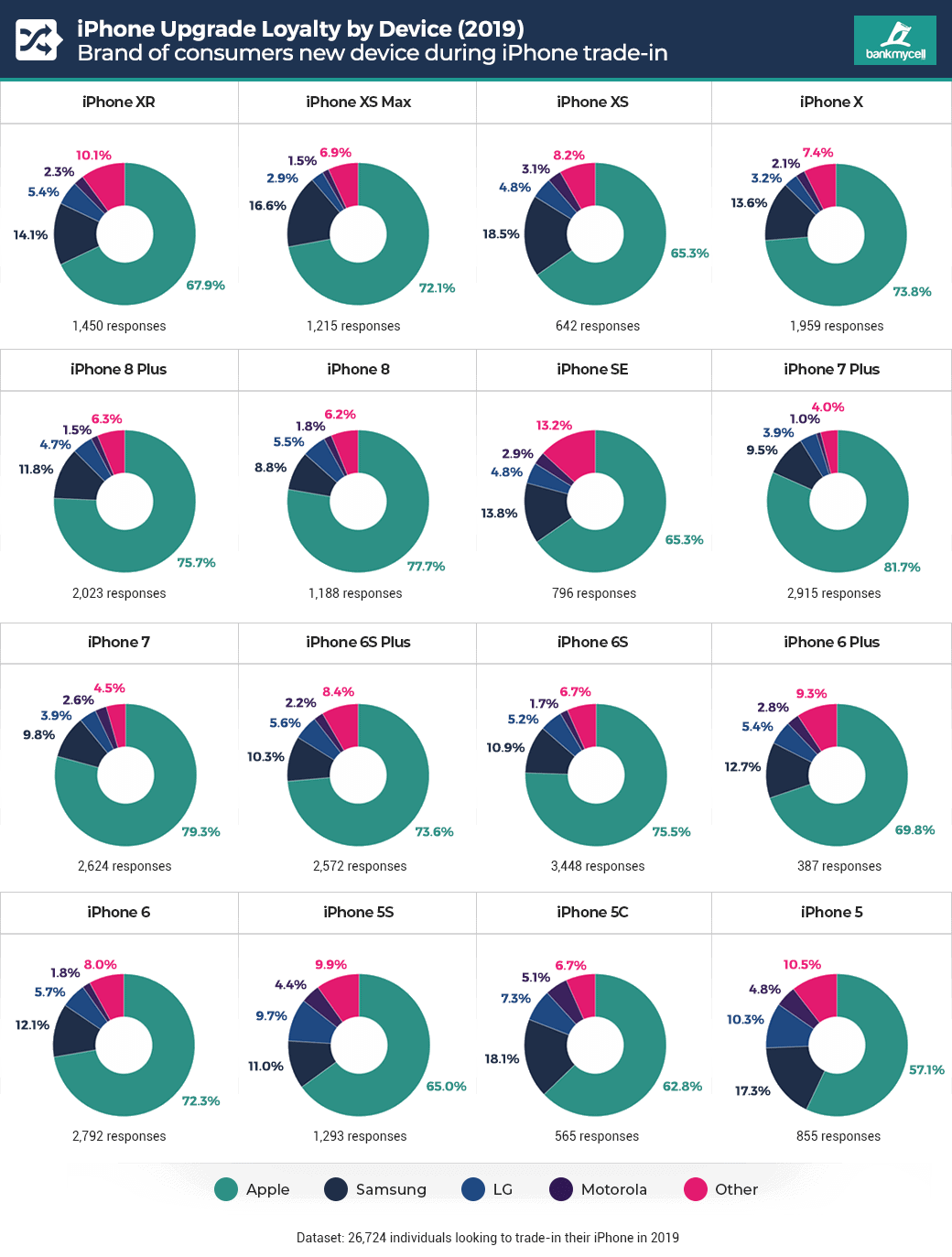

All iPhone Brand Loyalty Data by Phone

Methodology

BankMyCell’s report is based on the collection of brand, device and operating system data for marketing material, with the goal knowing the next device a consumer has to offer trade-in prices at various stages of the upgrade cycle.

This sizable dataset gave us a unique insight into consumer upgrade patterns within the trade-in market.

This iPhone trade-in report collected the following datasets:

- 38,043 unique Apple iPhone users

- 26,724 unique iPhone users where the model was defined

- In the case of the Galaxy S9 comparison, 468 unique users

- Our online audience 62.4% millennials / 37.6% were 36-65

- 60.7% female / 39.3% male gender split